The National Democratic Alliance

has completed a year in office and the media seems to be capturing its TRP

ratings through all the snap polls and Surveys that they have painstakingly

conducted across the country to commemorate the turn of the year for the

current government in power. What also began for me in the last week was when I

wielded my pen (keyboard rather) after a long time to begin to write again on

the current state of India-this time albeit not from a predominantly Foreign

Policy standpoint but from the perspective of a proponent of Economics. This

came about thanks to a rather interesting blog which I had come across from my

friend, Ritinkar Dasbhaumik about the priorities of the current government. In

my previous blog I had tried to address a few issues that he had raised in

principle to why I was countered in a subsequent response ,or inquiry (as I

would like to put it) that he had penned over the weekend. It is purely

coincidental that I am drafting this reply at a time when almost the entirety

of the nation is debating on the successes and failures of the Government on a

variety of fronts. However this debate, being a more nuanced one, deliberates

on the very basic priorities of the government that is at the helm of affairs

today. To put in more simpler terms, is this a “Suit-Boot” Sarkar or is this a

“Ganji-(Bina)Chappal” Sarkar.

I would obviously have to thank

Rahul Gandhi for the former jibe which seems to have struck the Nations mind

more successfully than he can or ever will probably be able to achieve but why

I gave the second coinage was for a reason. And that was to emphasise the

presence of the other end of the spectrum-The “Aam Admi” in common Indian

lexicon. It is absolutely foolish for any government to be completely engrossed

in the matters of the swank corporate offices and not remember the open fields

where the farmer is pondering whether to commit suicide or not. And that is

what the crux of the face-off has been about.

Does this Government think about Growth alone? Is this government not

really concerned about “Sabka Saath, Sabka Vikaas”? How has this government

faired on inclusivity, economic growth, social welfare and equitable

distribution of the fruits of growth over the past year? These three

questions will be the backbone of my argumentation trying to defend the turn of

events over the past year or so in India.

Before I answer this question,

let’s take a very quick analogy . I have just decided to refurbish the house

that I have been living in for the past 10 years. Now the task of refurbishing

is one which is very cumbersome because it entails a bit of new furniture,

applying primers on the walls, re-painting of the walls, renovation of bedrooms

and probably replacement of old furniture with new ones to match the renewed interiors

of the house. The Indian Economy and State is primarily in the midst of this

state of renovation which our Prime Minister has initiated. We are seeing a lot

of rethinking about the growth-path, development objectives, foreign policy

objectives and economic outlook that India should be projecting, over the

course of the past 1 year. And our economy is like this house going under

renovation. For a renovation to proceed, old furniture needs to be removed out

of the house, old walls probably need to be broken down as per the owner’s

convenience and a lot of other things happen simultaneously. That has exactly

been the state of the Economy over the past year. A lot of people have called

the Indian Economy, a new lab-rat for the Neoliberal Experiment, but I would

put it more as a “Work In Progress” area of the Global economy (much like that

room in a house which is torn apart to give it a new look).

. I have just decided to refurbish the house

that I have been living in for the past 10 years. Now the task of refurbishing

is one which is very cumbersome because it entails a bit of new furniture,

applying primers on the walls, re-painting of the walls, renovation of bedrooms

and probably replacement of old furniture with new ones to match the renewed interiors

of the house. The Indian Economy and State is primarily in the midst of this

state of renovation which our Prime Minister has initiated. We are seeing a lot

of rethinking about the growth-path, development objectives, foreign policy

objectives and economic outlook that India should be projecting, over the

course of the past 1 year. And our economy is like this house going under

renovation. For a renovation to proceed, old furniture needs to be removed out

of the house, old walls probably need to be broken down as per the owner’s

convenience and a lot of other things happen simultaneously. That has exactly

been the state of the Economy over the past year. A lot of people have called

the Indian Economy, a new lab-rat for the Neoliberal Experiment, but I would

put it more as a “Work In Progress” area of the Global economy (much like that

room in a house which is torn apart to give it a new look).

. I have just decided to refurbish the house

that I have been living in for the past 10 years. Now the task of refurbishing

is one which is very cumbersome because it entails a bit of new furniture,

applying primers on the walls, re-painting of the walls, renovation of bedrooms

and probably replacement of old furniture with new ones to match the renewed interiors

of the house. The Indian Economy and State is primarily in the midst of this

state of renovation which our Prime Minister has initiated. We are seeing a lot

of rethinking about the growth-path, development objectives, foreign policy

objectives and economic outlook that India should be projecting, over the

course of the past 1 year. And our economy is like this house going under

renovation. For a renovation to proceed, old furniture needs to be removed out

of the house, old walls probably need to be broken down as per the owner’s

convenience and a lot of other things happen simultaneously. That has exactly

been the state of the Economy over the past year. A lot of people have called

the Indian Economy, a new lab-rat for the Neoliberal Experiment, but I would

put it more as a “Work In Progress” area of the Global economy (much like that

room in a house which is torn apart to give it a new look).

. I have just decided to refurbish the house

that I have been living in for the past 10 years. Now the task of refurbishing

is one which is very cumbersome because it entails a bit of new furniture,

applying primers on the walls, re-painting of the walls, renovation of bedrooms

and probably replacement of old furniture with new ones to match the renewed interiors

of the house. The Indian Economy and State is primarily in the midst of this

state of renovation which our Prime Minister has initiated. We are seeing a lot

of rethinking about the growth-path, development objectives, foreign policy

objectives and economic outlook that India should be projecting, over the

course of the past 1 year. And our economy is like this house going under

renovation. For a renovation to proceed, old furniture needs to be removed out

of the house, old walls probably need to be broken down as per the owner’s

convenience and a lot of other things happen simultaneously. That has exactly

been the state of the Economy over the past year. A lot of people have called

the Indian Economy, a new lab-rat for the Neoliberal Experiment, but I would

put it more as a “Work In Progress” area of the Global economy (much like that

room in a house which is torn apart to give it a new look).

In the midst of this “Work in

Progress” phase that I have just spoken about a lot of shifts have been taking

place in the Indian Economy has also not been left behind. In fact it has been

the area where the Government has begun its work and is in the midst of

refurbishing the vital essences of the same in its own fashion. During this

process, I was faced with a debate on “Pro-Corporate vs Pro-Poor” ideologies of

the Indian establishment which in my previous blog I tried to put across by

saying that this “vs” sign should be replaced with a “-“ to indicate the State

of flux that the economy is in. Having once again introduced this

contextualisation of the economy let me now get down to a few key fundamentals

of the Prudence-Welfare debate again.

The NDA Government has inherited

an economy in absolute tatters. Not only had people within the country lost

faith on the ability of the India Growth Story to gain real footing in the

global economic corridors but investors had also begun to be sceptical of the

future of the Indian Economy in the midst of almost a decade of “Policy

Paralysis”. However in electing this current government, where we as a state

did go wrong is in the limbo of over-expectation which we decided to take

ourselves into. Narendra Modi, Arun Jaitley, Arvind Subhramaniam and Arvind

Panagriya are definitely not the names of magicians. They are the names of

people at the helm of affairs of an Emerging Market Economy with one-sixth of

the global population and a miniscule fraction of the global GDP. We sadly

expected them to be magicians which I had indicated in the latter parts of my

previous blog. Let me tell you why this has been an overestimation.

had also begun to be sceptical of the

future of the Indian Economy in the midst of almost a decade of “Policy

Paralysis”. However in electing this current government, where we as a state

did go wrong is in the limbo of over-expectation which we decided to take

ourselves into. Narendra Modi, Arun Jaitley, Arvind Subhramaniam and Arvind

Panagriya are definitely not the names of magicians. They are the names of

people at the helm of affairs of an Emerging Market Economy with one-sixth of

the global population and a miniscule fraction of the global GDP. We sadly

expected them to be magicians which I had indicated in the latter parts of my

previous blog. Let me tell you why this has been an overestimation.

had also begun to be sceptical of the

future of the Indian Economy in the midst of almost a decade of “Policy

Paralysis”. However in electing this current government, where we as a state

did go wrong is in the limbo of over-expectation which we decided to take

ourselves into. Narendra Modi, Arun Jaitley, Arvind Subhramaniam and Arvind

Panagriya are definitely not the names of magicians. They are the names of

people at the helm of affairs of an Emerging Market Economy with one-sixth of

the global population and a miniscule fraction of the global GDP. We sadly

expected them to be magicians which I had indicated in the latter parts of my

previous blog. Let me tell you why this has been an overestimation.

had also begun to be sceptical of the

future of the Indian Economy in the midst of almost a decade of “Policy

Paralysis”. However in electing this current government, where we as a state

did go wrong is in the limbo of over-expectation which we decided to take

ourselves into. Narendra Modi, Arun Jaitley, Arvind Subhramaniam and Arvind

Panagriya are definitely not the names of magicians. They are the names of

people at the helm of affairs of an Emerging Market Economy with one-sixth of

the global population and a miniscule fraction of the global GDP. We sadly

expected them to be magicians which I had indicated in the latter parts of my

previous blog. Let me tell you why this has been an overestimation.

The development agenda, described in the annual budget as “Vision

2022”, seeks to ensure employment, economic opportunity, housing, electricity,

water, sanitation, connectivity, medical facility and schools for all its

people by 2022, the 75th year of India’s independence. This is

taken from the very first page of the “India Development Update” of the World

Bank, published very recently. What is interesting to note is the timeline of

2022. This is because pragmactically speaking, none of this can be achieved by

any Government (Leftist, Rightist, Utilitarian, Majoritarian, Neoliberal etc.)

within a couple of years. What the very first full-fledged budget of this

Government set out to do is to clear the air between pragmatism and lofty

expectations. I am happy that they did. Because to promise all of these things

to a population of over 1.2 billion within a year would be as foolish as

Congress expecting to retain power in April 2014. Hence to confuse long term targets

with short term expectations is a folly at its very least. And all of these

aims that the Budget did set out were development oriented aims whose main

recipients would be the people in the hinterlands and the conspicuous corners

of the country today, and I will tie in this long term agenda of the Government

with the subsequent takeaways that I have had in the latter parts of this

piece.

My second key takeaway from this

Government would be its emphasis on Fiscal Prudence and trying to manage the

Fiscal Deficit. In dealing with these two issues very briefly as I have already

dealt with them majorly in my previous blog, I would like to draw inferences

from the Kelkar Committee Report on “Roadmap

for Fiscal Consolidation” which ushered in a new era of debate on Fiscal

Prudence in India. High fiscal deficits tend to heighten inflation, reduce room

for monetary policy stimulus, increase the risk of external sector imbalances

and dampen private investment , growth and employment. The consequences of not

quickly taking credible effective measures for correcting the current fiscal

deficit is likely to be a sovereign credit downgrade and flight of foreign

capital. This will invariably further weaken the rupee and negatively impact

the capital markets and the banking sector. The growing fiscal deficit also

leaves limited monetary space for lowering interest rates to stimulate private

investment and growth. Now the Twin Deficits hypothesis implies that given a

certain level of private savings, the deficits will have to balanced either

through a reduction in Private investment or through an increase in the Current

Account Deficit (CAD). The Government cannot simply print money or buy back its

own debt when it is a part of an open macroeconomy, particularly when legislatively

the FRBM Act of 2003 clearly states the Government cannot borrow money from the

RBI for purposes such as social welfare schemes. This leaves us with the path

of using available fiscal space to generate funds und plough these back into

the economy.

, growth and employment. The consequences of not

quickly taking credible effective measures for correcting the current fiscal

deficit is likely to be a sovereign credit downgrade and flight of foreign

capital. This will invariably further weaken the rupee and negatively impact

the capital markets and the banking sector. The growing fiscal deficit also

leaves limited monetary space for lowering interest rates to stimulate private

investment and growth. Now the Twin Deficits hypothesis implies that given a

certain level of private savings, the deficits will have to balanced either

through a reduction in Private investment or through an increase in the Current

Account Deficit (CAD). The Government cannot simply print money or buy back its

own debt when it is a part of an open macroeconomy, particularly when legislatively

the FRBM Act of 2003 clearly states the Government cannot borrow money from the

RBI for purposes such as social welfare schemes. This leaves us with the path

of using available fiscal space to generate funds und plough these back into

the economy.

, growth and employment. The consequences of not

quickly taking credible effective measures for correcting the current fiscal

deficit is likely to be a sovereign credit downgrade and flight of foreign

capital. This will invariably further weaken the rupee and negatively impact

the capital markets and the banking sector. The growing fiscal deficit also

leaves limited monetary space for lowering interest rates to stimulate private

investment and growth. Now the Twin Deficits hypothesis implies that given a

certain level of private savings, the deficits will have to balanced either

through a reduction in Private investment or through an increase in the Current

Account Deficit (CAD). The Government cannot simply print money or buy back its

own debt when it is a part of an open macroeconomy, particularly when legislatively

the FRBM Act of 2003 clearly states the Government cannot borrow money from the

RBI for purposes such as social welfare schemes. This leaves us with the path

of using available fiscal space to generate funds und plough these back into

the economy.

, growth and employment. The consequences of not

quickly taking credible effective measures for correcting the current fiscal

deficit is likely to be a sovereign credit downgrade and flight of foreign

capital. This will invariably further weaken the rupee and negatively impact

the capital markets and the banking sector. The growing fiscal deficit also

leaves limited monetary space for lowering interest rates to stimulate private

investment and growth. Now the Twin Deficits hypothesis implies that given a

certain level of private savings, the deficits will have to balanced either

through a reduction in Private investment or through an increase in the Current

Account Deficit (CAD). The Government cannot simply print money or buy back its

own debt when it is a part of an open macroeconomy, particularly when legislatively

the FRBM Act of 2003 clearly states the Government cannot borrow money from the

RBI for purposes such as social welfare schemes. This leaves us with the path

of using available fiscal space to generate funds und plough these back into

the economy. PHASE 1: INCREASE EXPENDITURE ONLY

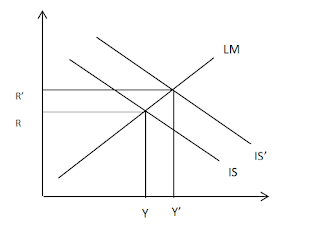

You can clearly see that if the

Government increases its expenditure although Income levels are going to

increase, there is going to be an increase in the rate of interest which is

going to crowd out private investment to a degree. To plug in this crowding out

of private investment there will probably have to be a slight increase in

government expenditure which may increase the interest rate even further thus

necessitating greater government spending and gradually marginalising private

investments to a bare minimum in the economy, which may put significant strains

on government exchequer and higher macroeconomic imbalances and ramifications

in the long run.

Now a government will not be able

to sustain this level of increase in expenditure if the Central Bank does not

lend it money for such expenditure. It will have to use its fiscal instruments.

Government expenditure can’t be reduced since it was required to be increased

in the first place. But what can be done is to increase the rates of taxation

in the economy which will usher in phase 2 as shown below:

PHASE 2: INCREASE TAXATION TO COVER FOR EXPENDITURE

So what happens in this phase is

the economy contracts from Y’ to Y” with the falling interest rates which are

only reducing the quantum of contraction by slightly crowding in private investment,

although that is not much use in such a fiscal policy where the disposable

income in the hands of the people are reduced and the aggregate demand in the

economy is lowered because the Government after all will have to fund this

increase in welfare expenditure from somewhere.

So we see that this cyclical

reliance on expenditure and taxation is only going to make the economy like a

Ping-Pong ball between higher and lower GDPs and none of us want that, as we

have established. So since the Government cannot adopt such a procedure very

regularly or wait for too long after massively increasing government

expenditure in order to recover its debt burden, that the Government is going

in right now for this case of Fiscal Prudence by cutting down initially on

welfare schemes for the time being.

However let us look at the other

side of the picture - Investment in Infrastructure and railways. Now the Economic

Survey spells out very clearly that what the Government and the economy need at

this point of time to get it on the growth path is greater injection of money

towards greater public investment expenditure rather than emphasising on

consumption priorities. Hence the motive to stress on investment towards

railways, and infrastructure development. It is very clearly spelled out in the

Economic Survey that an increase in the investment in railways by a single unit

has the capacity to increase output in the economy by 3.3 units (phenomena of

forward and backward linkages in operation). Modernization programmes,

increasing efficiency and tonnage capacities are only going to make sure that

the railways are up to scratch with regards to the needs of the people of the

country. Increasing railway efficiency will also make sure that transport of

goods and raw materials across the country is quicker and there are less delays

and hence wastages in the production process. Hence Railways have become a

priority. The other priority is infrastructure through investment in roads,

ports and so on to give greater connectivity to the different parts of the

nation and previously unconnected areas to make sure that the producers are

brought into closer contact with the markets, and there is greater mobilisation

of resources in the economy.

People may actually counter my

claim stating that by reducing expenditure on social welfare schemes the

Government may actually be curtailing generation of additional demand in the

economy if we follow the above model. However here lies the catch. The

Cumulative expenditure of the government in the Railway and the General Budget

on investment generating activities has in the net gone up creating a situation

somewhat similar to the one below:

PHASE 1.5 : NET INCREASE IN EXPENDITURE

So what we see here is what I was

indicating for a lion’s share of my argument. The net increase in the

Government expenditure as per Budget estimates over the previous year is to the

tune of 94,965 crores. I first drop Government Plan Expenditure to the level of

IS’ and then increase the Government expenditure through the net increase in expenditure

and also railway expenditure to the level of IS” which sees not only creation

of additional demand in the economy but also some additional crowding in of

private investments into the economy despite the overall increase in the interest

rates which may bog down investment sentiments slightly in the economy. Even if from this stage the Government does decide to slightly raise taxes we see that the net effect will still remain positive, the central exchequer is only going to have a greater influx and the economy will not be at the previous Ping-Pong state which I had spoken of above. And

that is once again what the Economic Survey has spoken about – Where Public

Investment takes a lead to bring in additional private investment into the

economy to solve the major roadblock in the Indian growth narrative which is

lack of domestic demand in the economy.

This influx of private investment

is being aimed at through a whole lot of measures such as a policy of single

taxation, Make in India (which I shall talk about in subsequent blogs), easing

up of doing business and increasing the positivity in investment sentiments

across the country.

My final takeaway from the

government’s 1 year in power has been the GST and the change in the tax regime

which has a lot of scope to alter the dynamics of the fiscal policy that the

government currently undertakes. The current system of a layered tax structure

whereby multiple taxes are charged at different rates during the system of

production has often made it cumbersome and very costly for manufacturers

across states in the country. Where the GST fits into this bill is that a

unified tax across the country for most commodities makes taxation far more

effective and simpler for the people to understand and afford in the economy.

When a GST unifies the total markets in the country as one single market with a

whole tax structure, it makes it very convenient for enterprises as well as

consumers to begin to be less apprehensive of this tax structure. One of the

major concerns in the economy is the tax-GDP ratio which also is being slated

for increase with this GST implementation, if it lives up to its promise of an

increase in the tax-base in the economy, which would thereby increase the

financial resources at the disposal of the centre and the state to invest more

heavily in welfare schemes in the coming years to meet its social sector

targets and Universal coverage of all welfare schemes by the year 2022.

After all this, we may still be

worried about Education, Universal Health-care coverage and a lot of welfare

schemes which are essential to the not-so well disposed people of the country.

What we must realize, and I once again cannot stress on this enough is that the

current Government needed to identify one or two priority sectors which it felt

could increase the potential in the Indian Economy. Unfortunately what we fail

to prioritize is the long term needs and structure of the economy over the

short term schematic relief that the poor in the economy may be given. I had

spoken of microfinance and the increasing impacts of incentives to mobilise the

savings in the economy and I will not go further ahead once again on that.

However what I would like to

conclude with is that the rational acumen that the people in the country have

today, we must realise that to gauge a government on revamping the structure of

an economy which has been essentially following the same underlying principle

since the inception of the Planning Commission is fallacious to say the least.

Structural reforms need more time and in the long term I see these structural

reforms that are being undertaken by the current government paying off. There

still needs to be detailed discussions on issues like the Land Bill, Labour

Laws and a lot of other schematics that the government finds itself on the

backfoot in, but consensus and positive, constructive inputs and criticism

transcending party line politics for the people of the country is probably what

the need of the hour is. The adage of “Good Economics, Bad Politics” is

probably clearly visible in the Indian Economy today on multiple indicators and

that could only change for the better in the coming 4 years of the NDA tenure.